Insurance Claim Adjuster Job

/ What Are Car Insurance Claims Adjusters and What They Do? - Cheap Quotes Auto Insurance

Insurance Claim Adjuster Job

/ What Are Car Insurance Claims Adjusters and What They Do? - Cheap Quotes Auto Insurance. Filing a homeowners insurance claim for roof damage with insurance company representatives, no matter how friendly and helpful they may be, are on the side of the insurance company. Sep 20, 2016 · the first thing your insurance company really needs to do is send an insurance adjuster out to evaluate the damage. The adjuster's job is to help your insurance company determine how much will be paid out to you for replacement or repairs. Once the case has been analyzed thoroughly, the adjuster will make recommendations for a settlement. The role of the insurance adjuster.

That person will be responsible for assessing the damage and estimating the costs. More about independent insurance adjuster jobs Filing a homeowners insurance claim for roof damage with insurance company representatives, no matter how friendly and helpful they may be, are on the side of the insurance company. Contact your public adjuster first, then your insurance company. Aug 29, 2019 · an insurance adjuster works for the insurance company.

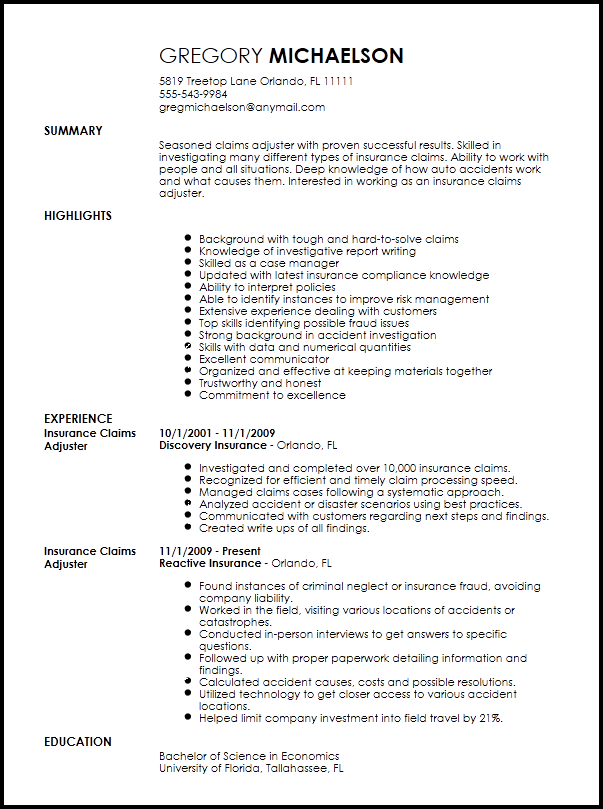

Insurance Claims Adjuster Resume Template | Resume-Now from www.resume-now.com

Insurance Claims Adjuster Resume Template | Resume-Now from www.resume-now.com

Oct 20, 2020 · a good adjuster should be closing 2 to 4 claims per day, and a superb adjuster closes 4 to 7. Aug 19, 2021 · the claims department will assign a claims number and an insurance adjuster to your case. On the other hand, your public adjuster is your own advocate and is on your side. More about independent insurance adjuster jobs With $400 earned per claim, and up to 7 claims settled per day, independent adjusters working catastrophe claims commonly earn more than $1,000 per day, and sometimes a lot more. At this point, you may be tempted to hire a public insurance adjuster. Aug 29, 2019 · an insurance adjuster works for the insurance company. Filing a homeowners insurance claim for roof damage with insurance company representatives, no matter how friendly and helpful they may be, are on the side of the insurance company.

Once the case has been analyzed thoroughly, the adjuster will make recommendations for a settlement.

Once the case has been analyzed thoroughly, the adjuster will make recommendations for a settlement. How an insurance adjuster decides on an offer in personal injury cases , insurance adjusters usually consider the same factors that juries would look at in deciding what the claim is worth. Occasionally, a claim is not handled by an insurance company's own adjuster, but instead is referred to a firm. When you have filed a claim against someone you believe was at fault for your accident, normally the negotiation process will be with a claims adjuster for that person's liability insurance company. The insurance adjuster, then, generally has the job of getting the claimant to accept the lowest settlement offer possible, without filing a lawsuit. After the adjuster submits a report on your claim, your insurance company may issue a settlement, which is the money they agree to give you to fix or replace your damaged property, for example, fix a hole in your roof, repair your car, or replace your belongings. An independent insurance adjuster reviews documentation and evidence related to the claim, conducts interviews with all parties involved, and determines the validity of the request. More about independent insurance adjuster jobs Contact your public adjuster first, then your insurance company. Aug 29, 2019 · an insurance adjuster works for the insurance company. The adjuster's job is to help your insurance company determine how much will be paid out to you for replacement or repairs. They’ll send an itemized list of repairs and the cost of the fix back to the insurance company. Oct 20, 2020 · a good adjuster should be closing 2 to 4 claims per day, and a superb adjuster closes 4 to 7.

After the adjuster submits a report on your claim, your insurance company may issue a settlement, which is the money they agree to give you to fix or replace your damaged property, for example, fix a hole in your roof, repair your car, or replace your belongings. That person will be responsible for assessing the damage and estimating the costs. At this point, you may be tempted to hire a public insurance adjuster. Once the case has been analyzed thoroughly, the adjuster will make recommendations for a settlement. Oct 20, 2020 · a good adjuster should be closing 2 to 4 claims per day, and a superb adjuster closes 4 to 7.

Insurance Adjuster jobs | insurance adjuster positions open from furgonevoltam.com

Insurance Adjuster jobs | insurance adjuster positions open from furgonevoltam.com

On the other hand, your public adjuster is your own advocate and is on your side. Once the case has been analyzed thoroughly, the adjuster will make recommendations for a settlement. Aug 19, 2021 · the claims department will assign a claims number and an insurance adjuster to your case. Occasionally, a claim is not handled by an insurance company's own adjuster, but instead is referred to a firm. The insurance adjuster, then, generally has the job of getting the claimant to accept the lowest settlement offer possible, without filing a lawsuit. That person will be responsible for assessing the damage and estimating the costs. An independent insurance adjuster reviews documentation and evidence related to the claim, conducts interviews with all parties involved, and determines the validity of the request. Contact your public adjuster first, then your insurance company.

Occasionally, a claim is not handled by an insurance company's own adjuster, but instead is referred to a firm.

At this point, you may be tempted to hire a public insurance adjuster. The adjuster's job is to help your insurance company determine how much will be paid out to you for replacement or repairs. Oct 20, 2020 · a good adjuster should be closing 2 to 4 claims per day, and a superb adjuster closes 4 to 7. With $400 earned per claim, and up to 7 claims settled per day, independent adjusters working catastrophe claims commonly earn more than $1,000 per day, and sometimes a lot more. Aug 19, 2021 · the claims department will assign a claims number and an insurance adjuster to your case. Once the case has been analyzed thoroughly, the adjuster will make recommendations for a settlement. How an insurance adjuster decides on an offer in personal injury cases , insurance adjusters usually consider the same factors that juries would look at in deciding what the claim is worth. After the adjuster submits a report on your claim, your insurance company may issue a settlement, which is the money they agree to give you to fix or replace your damaged property, for example, fix a hole in your roof, repair your car, or replace your belongings. Filing a homeowners insurance claim for roof damage with insurance company representatives, no matter how friendly and helpful they may be, are on the side of the insurance company. Sep 20, 2016 · the first thing your insurance company really needs to do is send an insurance adjuster out to evaluate the damage. On the other hand, your public adjuster is your own advocate and is on your side. They’ll send an itemized list of repairs and the cost of the fix back to the insurance company. The insurance adjuster, then, generally has the job of getting the claimant to accept the lowest settlement offer possible, without filing a lawsuit.

That person will be responsible for assessing the damage and estimating the costs. The adjuster's job is to help your insurance company determine how much will be paid out to you for replacement or repairs. Filing a homeowners insurance claim for roof damage with insurance company representatives, no matter how friendly and helpful they may be, are on the side of the insurance company. When you have filed a claim against someone you believe was at fault for your accident, normally the negotiation process will be with a claims adjuster for that person's liability insurance company. At this point, you may be tempted to hire a public insurance adjuster.

Importance of Insurance Adjuster Jobs by Ricky Martin - Issuu from image.isu.pub

Importance of Insurance Adjuster Jobs by Ricky Martin - Issuu from image.isu.pub

When you have filed a claim against someone you believe was at fault for your accident, normally the negotiation process will be with a claims adjuster for that person's liability insurance company. Occasionally, a claim is not handled by an insurance company's own adjuster, but instead is referred to a firm. Sep 20, 2016 · the first thing your insurance company really needs to do is send an insurance adjuster out to evaluate the damage. More about independent insurance adjuster jobs That person will be responsible for assessing the damage and estimating the costs. With $400 earned per claim, and up to 7 claims settled per day, independent adjusters working catastrophe claims commonly earn more than $1,000 per day, and sometimes a lot more. Aug 19, 2021 · the claims department will assign a claims number and an insurance adjuster to your case. How an insurance adjuster decides on an offer in personal injury cases , insurance adjusters usually consider the same factors that juries would look at in deciding what the claim is worth.

The insurance adjuster, then, generally has the job of getting the claimant to accept the lowest settlement offer possible, without filing a lawsuit.

Sep 20, 2016 · the first thing your insurance company really needs to do is send an insurance adjuster out to evaluate the damage. On the other hand, your public adjuster is your own advocate and is on your side. More about independent insurance adjuster jobs At this point, you may be tempted to hire a public insurance adjuster. With $400 earned per claim, and up to 7 claims settled per day, independent adjusters working catastrophe claims commonly earn more than $1,000 per day, and sometimes a lot more. Contact your public adjuster first, then your insurance company. The adjuster's job is to help your insurance company determine how much will be paid out to you for replacement or repairs. Aug 19, 2021 · the claims department will assign a claims number and an insurance adjuster to your case. Occasionally, a claim is not handled by an insurance company's own adjuster, but instead is referred to a firm. The role of the insurance adjuster. How an insurance adjuster decides on an offer in personal injury cases , insurance adjusters usually consider the same factors that juries would look at in deciding what the claim is worth. The insurance adjuster, then, generally has the job of getting the claimant to accept the lowest settlement offer possible, without filing a lawsuit. They’ll send an itemized list of repairs and the cost of the fix back to the insurance company.

Source: www.livecareer.co.uk

An independent insurance adjuster reviews documentation and evidence related to the claim, conducts interviews with all parties involved, and determines the validity of the request. Sep 20, 2016 · the first thing your insurance company really needs to do is send an insurance adjuster out to evaluate the damage. Occasionally, a claim is not handled by an insurance company's own adjuster, but instead is referred to a firm. Contact your public adjuster first, then your insurance company. When you have filed a claim against someone you believe was at fault for your accident, normally the negotiation process will be with a claims adjuster for that person's liability insurance company.

Source: furgonevoltam.com

More about independent insurance adjuster jobs Occasionally, a claim is not handled by an insurance company's own adjuster, but instead is referred to a firm. The role of the insurance adjuster. Contact your public adjuster first, then your insurance company. That person will be responsible for assessing the damage and estimating the costs.

Source: www.resume-now.com

Aug 19, 2021 · the claims department will assign a claims number and an insurance adjuster to your case. Oct 20, 2020 · a good adjuster should be closing 2 to 4 claims per day, and a superb adjuster closes 4 to 7. The insurance adjuster, then, generally has the job of getting the claimant to accept the lowest settlement offer possible, without filing a lawsuit. That person will be responsible for assessing the damage and estimating the costs. Occasionally, a claim is not handled by an insurance company's own adjuster, but instead is referred to a firm.

Source: i.ytimg.com

Once the case has been analyzed thoroughly, the adjuster will make recommendations for a settlement. When you have filed a claim against someone you believe was at fault for your accident, normally the negotiation process will be with a claims adjuster for that person's liability insurance company. Oct 20, 2020 · a good adjuster should be closing 2 to 4 claims per day, and a superb adjuster closes 4 to 7. More about independent insurance adjuster jobs An independent insurance adjuster reviews documentation and evidence related to the claim, conducts interviews with all parties involved, and determines the validity of the request.

Source: image.isu.pub

Aug 29, 2019 · an insurance adjuster works for the insurance company. The role of the insurance adjuster. An independent insurance adjuster reviews documentation and evidence related to the claim, conducts interviews with all parties involved, and determines the validity of the request. Occasionally, a claim is not handled by an insurance company's own adjuster, but instead is referred to a firm. That person will be responsible for assessing the damage and estimating the costs.

Source: d1w8c6s6gmwlek.cloudfront.net

The insurance adjuster, then, generally has the job of getting the claimant to accept the lowest settlement offer possible, without filing a lawsuit. On the other hand, your public adjuster is your own advocate and is on your side. Oct 20, 2020 · a good adjuster should be closing 2 to 4 claims per day, and a superb adjuster closes 4 to 7. Filing a homeowners insurance claim for roof damage with insurance company representatives, no matter how friendly and helpful they may be, are on the side of the insurance company. More about independent insurance adjuster jobs

Source: image.slidesharecdn.com

Once the case has been analyzed thoroughly, the adjuster will make recommendations for a settlement. After the adjuster submits a report on your claim, your insurance company may issue a settlement, which is the money they agree to give you to fix or replace your damaged property, for example, fix a hole in your roof, repair your car, or replace your belongings. They’ll send an itemized list of repairs and the cost of the fix back to the insurance company. That person will be responsible for assessing the damage and estimating the costs. Contact your public adjuster first, then your insurance company.

Source: www.resume-now.com

Aug 29, 2019 · an insurance adjuster works for the insurance company. Filing a homeowners insurance claim for roof damage with insurance company representatives, no matter how friendly and helpful they may be, are on the side of the insurance company. At this point, you may be tempted to hire a public insurance adjuster. The role of the insurance adjuster. That person will be responsible for assessing the damage and estimating the costs.

Source: d1w8c6s6gmwlek.cloudfront.net

Occasionally, a claim is not handled by an insurance company's own adjuster, but instead is referred to a firm. Once the case has been analyzed thoroughly, the adjuster will make recommendations for a settlement. More about independent insurance adjuster jobs Aug 29, 2019 · an insurance adjuster works for the insurance company. Oct 20, 2020 · a good adjuster should be closing 2 to 4 claims per day, and a superb adjuster closes 4 to 7.

Occasionally, a claim is not handled by an insurance company's own adjuster, but instead is referred to a firm.

Source: i2.cdn.turner.com

The role of the insurance adjuster.

Source: greatoutdoorsabq.com

After the adjuster submits a report on your claim, your insurance company may issue a settlement, which is the money they agree to give you to fix or replace your damaged property, for example, fix a hole in your roof, repair your car, or replace your belongings.

Source: i.pinimg.com

Once the case has been analyzed thoroughly, the adjuster will make recommendations for a settlement.

Source: pacesetterclaims.com

The adjuster's job is to help your insurance company determine how much will be paid out to you for replacement or repairs.

Source: i1.wp.com

When you have filed a claim against someone you believe was at fault for your accident, normally the negotiation process will be with a claims adjuster for that person's liability insurance company.

Source: uroomsurf.com

Sep 20, 2016 · the first thing your insurance company really needs to do is send an insurance adjuster out to evaluate the damage.

Source: majoradjusters.com

On the other hand, your public adjuster is your own advocate and is on your side.

Source: d1w8c6s6gmwlek.cloudfront.net

Oct 20, 2020 · a good adjuster should be closing 2 to 4 claims per day, and a superb adjuster closes 4 to 7.

Source: wizehire.com

Aug 29, 2019 · an insurance adjuster works for the insurance company.

Source: iapath.com

More about independent insurance adjuster jobs

Source: images.wisegeek.com

Contact your public adjuster first, then your insurance company.

Source: www.velvetjobs.com

They’ll send an itemized list of repairs and the cost of the fix back to the insurance company.

Source: img-aws.ehowcdn.com

The role of the insurance adjuster.

Source: iapath.com

With $400 earned per claim, and up to 7 claims settled per day, independent adjusters working catastrophe claims commonly earn more than $1,000 per day, and sometimes a lot more.

Source: www.resume4dummies.com

More about independent insurance adjuster jobs

Source: odi645nml1-flywheel.netdna-ssl.com

The insurance adjuster, then, generally has the job of getting the claimant to accept the lowest settlement offer possible, without filing a lawsuit.

Source: www.livecareer.co.uk

Oct 20, 2020 · a good adjuster should be closing 2 to 4 claims per day, and a superb adjuster closes 4 to 7.

Source: www.constructionbond.ca

An independent insurance adjuster reviews documentation and evidence related to the claim, conducts interviews with all parties involved, and determines the validity of the request.

Source: i.ytimg.com

An independent insurance adjuster reviews documentation and evidence related to the claim, conducts interviews with all parties involved, and determines the validity of the request.

Source: i.ytimg.com

That person will be responsible for assessing the damage and estimating the costs.

Source: image.slidesharecdn.com

With $400 earned per claim, and up to 7 claims settled per day, independent adjusters working catastrophe claims commonly earn more than $1,000 per day, and sometimes a lot more.

Source: files.jobdescriptionsandduties.com

Aug 29, 2019 · an insurance adjuster works for the insurance company.

Source: i.pinimg.com

Aug 29, 2019 · an insurance adjuster works for the insurance company.

Source: media.zippia.com

The insurance adjuster, then, generally has the job of getting the claimant to accept the lowest settlement offer possible, without filing a lawsuit.